Tuesday, October 27, 2020

Harshad Mehta Scam 1992 Download

Thursday, October 15, 2020

Price to Earnings Ratio and Price to Dividend Capacity ratio of all Nepali Commercial Banks - 29th Asoj 2077

Wednesday, October 14, 2020

Sanima General Insurance IPO Allotment

Thursday, October 8, 2020

22nd Asoj 2077 Latest P/E ratio and P/D ratio of all Nepali Commercial Banks

Price to earning ratio is an important indicator to evaluate a company and make a buying decision. Investors can compare which company is best to buy based on the current price. However, the PE ratio they get on the quarterly report is outdated because prices fluctuate daily. Here is the list of latest PE ratio and PD ratio of all Nepali commercial banks arranged in ascending order.

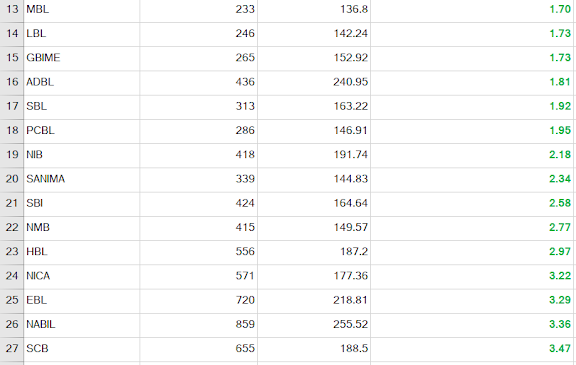

BASED ON P/E RATIO:

BASED ON P/D Ratio:

Monday, October 5, 2020

19th Asoj 2077 Latest PE ratio and PD ratio of Nepali Commercial Banks

Price to earning ratio is an important indicator to evaluate a company and make a buying decision. Investors can compare which company is best to buy based on the current price. However, the PE ratio they get on the quarterly report is outdated because prices fluctuate daily. Here is the list of latest PE ratio and PD ratio of all Nepali commercial banks arranged in ascending order.

19th Asoj Price to Book Value per Share Ratio of All Nepali Commercial Banks

The price to book value or PBV ratio is an effective indicator for value investors to choose a good company to invest upon. The latest book value and Last transaction price along with the respective PBV ratio (as per the price of 19th Asoj 2077) calculated is shown in the chart below.

Sunday, October 4, 2020

18th Asoj Book Value per Share of All Nepali Commercial Banks

Friday, October 2, 2020

Sanima General Insurance IPO Notice

Sanima General Insurance Limited has published an announcement to issue 30 lakhs units of general shares with unit price of NRs. 100. Out of the issued total 30 lakhs units, 1 lakh 20 thousand units (4 percent of the total issue) have been reserved for the employees of the company and 1 lakh 50 thousand units (5 percent) have been reserved for institutional investors and different mutual funds.

Total units available for the general public: 27 lakhs 30 thousand units.

Investors can apply for a minimum of 10 units and maximum of 1000 units.

Initial Date of opening : 2077/06/21

Last Date for application (early): 2077/06/25

Thursday, October 1, 2020

What is Book Value of a Share?

Book value is the total value of a business' assets found on its balance sheet, and represents the value of all assets if liquidated. The market value may be more or less than the book value based on the confidence of investors on the future of company, it's estimated earning potential and its potential to generate new income streams. The market value multiplied by the total number of outstanding shares gives the market capitalization of a particular company. But, the book value per share (BVPS) multiplied by the total number of shares outstanding gives the actual value of the company.

Value investors generally consider book value and price to book value ratio (PBV) a very important indicator to determine whether a stock is undervalued or overvalued. Price to book value is the ratio of the company's current market price to its book value. A company with market price of Rs. 300 per share and book value of Rs. 200 per share has PBV ratio of 300/200 i.e. 1.5. The lower the book value, the better it is to invest. When at times, the company's market price is less than the book value, very large corporate investors buy all the stocks of the company and liquidate it to gain definite profit. Generally, PBV ratio of less than 3 is considered a good investment if other financial indicators are fine as well.

I have compiled the list of book values of all the commercial banks of Nepal, their latest share price, and the PBV ratio. I have arranged them in ascending order from least to the greatest so that value investors can make their most prudent decision in buying stocks based on the PBV ratio.

For strategic investment, one should consider other indicators like Earning per share (EPS), Price to earning ratio (PE ratio) and other multiple things too.

NOTE: Investment in stocks bears risk of losing the capital as well as the opportunity to turn your hard earned cash into a fortune. The publisher do not endorse buying any particular stock and is not liable for any losses incurred by the readers should they make any investments based on these figures. You are solely responsible for all your investment decisions.

-

Retirement is a stage of life that many people look forward to, but it requires careful planning to ensure a comfortable and secure future. ...

-

In the world of stock market investing, every investor dreams of finding that one stock that could potentially multiply their initial inves...

-

Becoming a Crorepati (a millionaire) is a dream for many people, but it can seem like an unattainable goal. However, with careful planning ...