Book value is the total value of a business' assets found on its balance sheet, and represents the value of all assets if liquidated. The market value may be more or less than the book value based on the confidence of investors on the future of company, it's estimated earning potential and its potential to generate new income streams. The market value multiplied by the total number of outstanding shares gives the market capitalization of a particular company. But, the book value per share (BVPS) multiplied by the total number of shares outstanding gives the actual value of the company.

Value investors generally consider book value and price to book value ratio (PBV) a very important indicator to determine whether a stock is undervalued or overvalued. Price to book value is the ratio of the company's current market price to its book value. A company with market price of Rs. 300 per share and book value of Rs. 200 per share has PBV ratio of 300/200 i.e. 1.5. The lower the book value, the better it is to invest. When at times, the company's market price is less than the book value, very large corporate investors buy all the stocks of the company and liquidate it to gain definite profit. Generally, PBV ratio of less than 3 is considered a good investment if other financial indicators are fine as well.

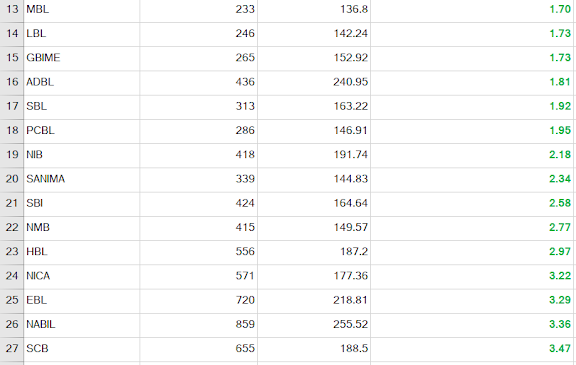

I have compiled the list of book values of all the commercial banks of Nepal, their latest share price, and the PBV ratio. I have arranged them in ascending order from least to the greatest so that value investors can make their most prudent decision in buying stocks based on the PBV ratio.

For strategic investment, one should consider other indicators like Earning per share (EPS), Price to earning ratio (PE ratio) and other multiple things too.

NOTE: Investment in stocks bears risk of losing the capital as well as the opportunity to turn your hard earned cash into a fortune. The publisher do not endorse buying any particular stock and is not liable for any losses incurred by the readers should they make any investments based on these figures. You are solely responsible for all your investment decisions.

No comments:

Post a Comment